Understanding the Tax Gap

Understanding the Tax Gap Published: 4/18/2025 While more and more legislation is introduced that penalizes all of us for doing things wrong on our tax returns, please remember that at its origin, tax collection in the U.S. is voluntary. In other words, the tax code is defined, we are given due dates, and the government […]

It’s Tax Day!

It’s Tax Day! Here are some last-minute details and tips Published: 4/15/2025 With the individual tax-filing deadline on Tuesday, April 15th, if you have not already done so, now is the time to complete all filing arrangements and payments. While this information is provided in our filing instructions, it makes sense to provide this information […]

Common Overlooked Taxable Events

Common Overlooked Taxable Events Published: 4/8/2025 Here are seven tax topics that seem innocent but can cause problems if not handled correctly. 1. Gambling winnings. If you receive a tax form at a casino for your winnings, that information is sent to the tax authorities. Since the form typically only contains the amount you won, save […]

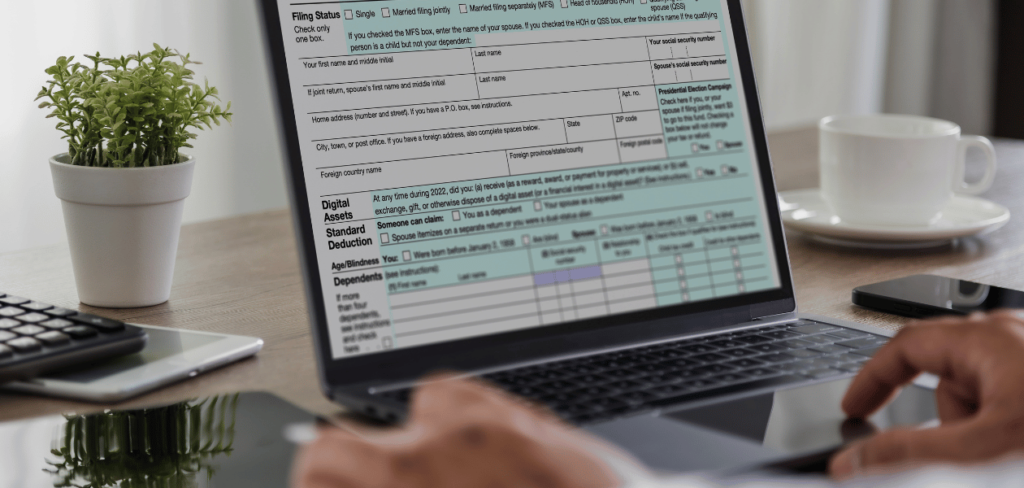

Pesky Tax Return Delays

Pesky Tax Return Delays Published: 4/4/2025 Wondering why your tax return is not finished? The delay can often come from one or two items that were overlooked and are needed to complete your tax return. Here are some of the most common: Missing statements. This includes all W-2s and 1099s, including any related to gambling winnings, […]

Ideas to Improve Your Personal Cash Flow

Ideas to Improve Your Personal Cash Flow Published: 4/3/2025 One of the most common reasons businesses fail is due to lack of proper cash flow. The same is often true in many households. Here’s how this concept of cash flow applies to you along with some ideas to improve it. Cash flow defined Cash flow […]

Manage Your Business’s Unemployment Taxes

Manage Your Business’s Unemployment Taxes Published: 3/28/2025 As a business owner, you’re required to pay three different types of payroll taxes. FICA (Federal Insurance Contributions Act) is the tax used to fund Social Security and Medicare programs. FUTA (Federal Unemployment Tax Act). Employers pay this federal tax to provide unemployment benefits to laid-off workers. SUTA […]

Scammers Up Their Game With AI

Scammers Up Their Game With AI Published: 3/25/2025 Scammers are becoming increasingly sophisticated, with more emails, phone calls and text messages crafted to look and sound like the real thing. This is often because thieves are adding artificial intelligence to its arsenal of tools to transform their tricks into messaging that genuinely looks like its […]

The New Banking Problem

The New Banking Problem Published: 3/21/2025 Immediate Required Action: Review your savings account interest rate and take necessary action to avoid potential deceptive, unreasonable, and obscure rules that are keeping your money from making a reasonable interest rate! Background When interest rates rose due to inflation, banks and credit unions quickly raised their interest rates […]

Tax Uncertainty Requires Preparedness

Tax Uncertainty Requires Preparedness Published: 3/19/2025 You will soon have to confront a higher tax bill if Congress doesn’t extend many credits, deductions, and lower tax rates that are set to expire at the end of this year. Here’s who should be considering ongoing tax planning sessions as this uncertainty plays out in Congress and […]

Tax Return Information That’s Easy to Miss

Tax Return Information That’s Easy to Miss Published: 3/14/2025 To ensure your tax return is filed quickly and without error, double-check this list of commonly-overlooked items. These little pesks are among the commonly missed items reported as hold ups to filing individual tax returns: Missing forms. Using last year’s tax return as a checklist, double […]